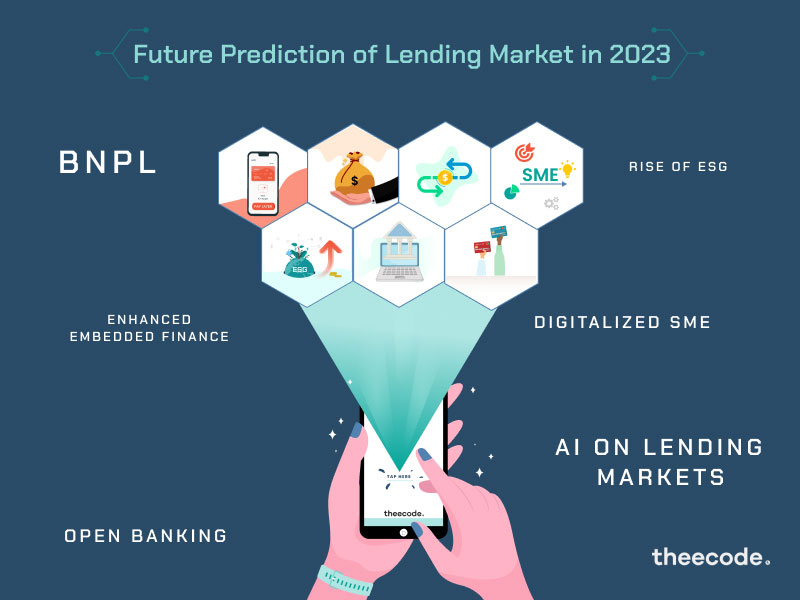

Future Prediction of Lending Market in 2023

With the arrival of a new year, it's time to reflect on the past and anticipate

the future of the lending market in the fintech industry. The industry is

constantly advancing, and it's expected that new technologies will surface and

shape its landscape by the end of 2023. The pandemic has accelerated digital

transformation in the financial sector as the demand for digital services grew

with social distancing measures. SaaS platforms reduce infrastructure costs for

financial companies and enable fintech startups to launch their operations

quickly and efficiently. SaaS-based solutions allow both established financial

institutions and startups to easily scale up operations, quickly develop and

deploy new digital products and services, and upgrade their skills to meet

changing client demands.

Evolution of finance from traditional methods to alternative financing

-

The evolution of finance has gone through several stages, starting from

traditional methods such as banks and credit unions to alternative

financing methods such as crowdfunding and peer-to-peer lending.

-

In the traditional finance system, banks were the primary source of

financing for individuals and businesses. However, with the rise of

technology and the internet, alternative financing options have emerged.

These options offer more flexible and convenient financing solutions,

often at lower costs and with fewer requirements than traditional banks.

-

Crowdfunding, for instance, allows individuals to pool funds to finance

projects or ventures. Peer-to-peer lending enables individuals to lend

money directly to other individuals, bypassing the need for banks as

intermediaries. Another alternative financing option is online lending,

where technology platforms match borrowers and lenders, often providing

faster and more accessible loans than traditional banks.

-

The evolution of finance has seen a shift from traditional methods

towards alternative financing methods, as technology has made financing

more accessible and convenient for individuals and businesses. Even in

2023, alternative financing platforms will leverage technologies such as

machine learning and AI to streamline the loan application and

underwriting process, offering more customized loan options that cater

to individual borrowers and small businesses. With greater popularity

and usage, alternative financing is also likely to face increased

regulatory scrutiny in 2023, aimed at protecting consumers and ensuring

the stability of the financial system. To gain further insight, we

sought predictions on what we can expect in the next 12 months for the

lending industry.

BNPL( Buy Now, Pay Later)

The pandemic-induced economic shifts have spurred an increase in online

shopping, leading consumers, especially tech-savvy millennials and Gen Z, to

turn to micro-credits and Buy Now Pay Later (BNPL) services for a smoother

online shopping experience. More businesses are entering the BNPL sector and

conventional banks are partnering with

cutting-edge fintech to offer BNPL services. BNPL mode of payment is looking to

grow exponentially in the coming years, especially in 2023

SME( Small and Medium Enterprises) Loans Supporting the Digitization of Small

Businesses

-

In recent years, the rise of digital technology has improved efficiency

and revenue for small businesses. SMEs are gradually adopting digital

tools for data collection, trend analysis, and decision-making. They are

using business loans to digitize their enterprises and expand their

business, bridge communication gaps, reach remote and rural customers,

and stay updated with changing buyer demands. A strong, frictionless,

and resilient digital platform like UPI is helping provide quick and

simple loans to SMEs and small business owners.

-

The adoption of digital ledger books by businesses has increased,

allowing them to manage their client base, track consumer credit, and

analyze transactions for valuable insights and informal credit scoring.

This offers lenders an opportunity to expand their business and meet the

growing credit demand.

The power of AI making banking efficient

-

By 2023, many banks will transform into tech firms that provide digital

services, taking advantage of their large customer base and widespread

channels. They will face competition from tech companies in areas such

as fraud detection and compliance due to the latter's access to advanced

analytics and ability to handle vast amounts of data.

-

NLP ( Natural language processing) will become the standard for customer

interaction in 2023. Chatbots and virtual assistants are already making

an impact across industries, but their adaptability makes them

particularly useful in banking

-

Banks should leverage this tech to improve customer experience, such as

providing automated answers to common questions, reducing call centre

volume, and pre-screening candidates to free up staff for more crucial

tasks. By 2023, these technologies will become common in banking apps on

various devices, including smartphones and tablets.

-

AI can also help lenders in the underwriting process by analyzing vast

amounts of data and helping to identify potential borrowers who are most

likely to repay the loan. This can involve using machine learning

algorithms to analyze financial data, social media profiles, and other

relevant information. In underwriting, AI can help automate the process

by using algorithms to analyze financial data and other relevant

information to assess the creditworthiness of a potential borrower. AI

can also be used to help identify potential fraud, assess the risk of

default, and provide recommendations for loan approval or denial.

Embedded finance

-

The embedded finance industry has seen significant growth in the

past 2 years, fueled by the COVID-19 pandemic which accelerated

e-commerce and digitalization in finance and changed consumers'

expectations. Fintech firms have gained consumers' trust in

financial services, rivalling and even surpassing traditional banks

in some cases. This presents ample opportunities for embedded

finance.

-

In 2023, it is expected that embedded finance will gain wider

adoption in emerging markets, led by inclusive fintech startups that

aim to serve consumers who were previously underserved by

traditional finance. The less restrictive environment and lower

costs in emerging markets can also stimulate further innovation.

-

Additionally, we may see deeper partnerships between traditional

financial services and fintech companies in support of embedded

finance, particularly between banks and payment companies. Banks can

provide essential infrastructure while payment fintech brings

inclusivity and customized services for various business models.

-

Finally, there will be a heightened focus on technology and

operational capabilities to address challenges such as risk and

compliance management in embedded finance. Technologies like cloud

computing and AI will have a multiplying effect across industries,

enhancing their ability to embrace embedded finance.

Revised Cross-border Payments

-

Payments are an integral part of our life because the movement of

people, goods, services, and funds will dictate growth. The remittance

industry, for instance, will be affected by people's displacement due to

disasters and conflict. There is talk that independence will replace

global interdependence in B2B scenarios.

-

However, globalization is deeply ingrained in the worldwide economy, and

the dynamics between developed and developing nations will continue.

Therefore, capital will continue to flow across borders, and fintech has

a crucial role to play in facilitating this. This may include supporting

sellers to expand across borders through digital commerce or enabling

tech companies to access worldwide expertise and support from freelancer

hubs. The world is more interconnected than ever, and fintech acts as

the global connector when it comes to cross-border business.

- Variable recurring payments refer to payments that are made on a regular

basis (e.g. monthly, annually), but with the amount that changes over

time. This could be due to several reasons such as changes in the cost

of goods or services being paid for, exchange rate fluctuations, or

agreed-upon price increases.

Variable Recurring Payments

-

In 2023, the use of variable recurring payments is likely to increase as

more businesses adopt subscription-based models and as consumers become

more accustomed to paying for goods and services in this manner. The

ability to adjust payment amounts in response to changing circumstances

is likely to be seen as a positive for both consumers and businesses, as

it allows for greater flexibility and can help to ensure that payments

are always fair and accurate.

-

However, it's important to note that the use of variable recurring

payments may also lead to confusion and misunderstandings if the changes

are not clearly communicated to

consumers. To minimize the risk of this happening, businesses using this

payment model should be transparent about their policies and procedures

for adjusting payment amounts and should provide clear notifications to

customers in advance of any changes.

Rise of ESG credit

-

ESG (Environmental, Social, and Governance) credit refers to a type of

financial product that considers environmental, social, and governance

factors in its investment decisions. ESG credit products are typically

bonds or loans issued by companies or governments with a strong focus on

sustainability and responsible business practices. In 2023, ESG credit

is expected to continue its trend as a growing segment of the lending

market, driven by increased investor demand and recognition of the

financial benefits of sustainable business practices. Lenders and

financial institutions may start offering more ESG credit products and

services, leading to greater availability and competition in the market.

This trend may also encourage companies to adopt more sustainable

business practices in order to access ESG credit and attract investment.

However, the exact impact will depend on factors such as the regulatory

environment, market conditions, and investor sentiment.

Open banking in MENA

-

The future of open banking in the Middle East and North Africa (MENA)

region in 2023 is expected to be characterized by rapid growth and

increasing adoption. As the fintech industry continues to expand, more

financial institutions are likely to embrace open banking and offer APIs

to third-party providers. This will drive innovation and competition,

leading to new and improved financial products and services for

customers. In addition, the increased availability of financial data and

the use of advanced technologies such as artificial intelligence and

machine learning, are likely to further enhance the value of open

banking in the region. The regulatory environment in MENA is also

evolving, and regulators are expected to continue to play a key role in

shaping the future of open banking in the region. Despite the growth

potential, open banking in MENA may face challenges such as

cybersecurity risks and limited consumer trust, which may impact its

future growth.

Conclusion

-

In 2023, fintech lending is likely to continue its upward trend, with an

increasing number of consumers and businesses opting for digital lending

solutions over traditional methods. As financial technology advances,

fintech lenders will be able to offer more personalized and accessible

loan options, and improvements in the areas of risk assessment and fraud

detection will make the lending process more secure. Additionally, the

continued growth of e-commerce and the shift towards a cashless society

will drive demand for digital lending solutions.

-

As the demand for fintech solutions grows in 2023, Theecode has refined

its approach to digital lending by offering a versatile product (

Embedded Lending Framework) that can meet your specific lending needs.

This product acts as a testing ground for your fintech startup idea and

can be launched in just 60 seconds, at no cost. Given the promising

future of the fintech industry, would you spend 60 secs in giving your

fintech idea a shot?