FINTECH ✦ RETAIL ✦ SUPPLYCHAIN ✦ FINTECH ✦ RETAIL ✦ SUPPLYCHAIN ✦

Experience our platform firsthand in the sandbox—no demos, just direct access. Trust through exploration.

FINTECH ✦ RETAIL ✦ SUPPLYCHAIN ✦ FINTECH ✦ RETAIL ✦ SUPPLYCHAIN ✦

In a world defined by digital transactions, our Fintech solution emerges as the pioneer, reshaping the financial landscape through cutting-edge technology. From the seamless automation of auto lending processes to the empowerment of individuals and businesses with flexible lines of credit options, we redefine financial access.

Delving deeper, our 'Buy Now, Pay Later' service provides a frictionless shopping experience, while healthcare lending ensures that well-being remains uncompromised. By innovatively combining these services on one platform, Theecode's Fintech solution creates a comprehensive ecosystem that empowers users to manage their financial needs with ease.

In a world defined by digital transactions, our In the evolving retail landscape, Theecode's Retail solution reimagines every point of interaction. With a focus on point-of-sale technology, we empower businesses to engage customers more meaningfully. Seamlessly integrating e-commerce platforms with physical stores, we craft a unified shopping journey.

From tapping into the potential of blockchain for asset verification to transforming retail spaces with immersive experiences, our solution aligns with the demands of the modern consumer. Theecode elevates the retail realm, offering a holistic approach that harmonizes technology, customer engagement, and business growth.

In the dynamic realm of supply chain management, Theecode's solution stands as a catalyst for progress. Embracing blockchain technology and asset tokenization, we streamline processes, enhance transparency, and secure transactions across industries. From optimizing logistics to revolutionizing e-commerce experiences, our comprehensive suite of services brings new efficiencies.

By providing end-to-end solutions, Theecode empowers businesses to navigate complexities effortlessly, ensuring that products reach their destinations seamlessly. Our Supply Chain solution fosters a resilient ecosystem that fuels growth and innovation, setting the stage for a new era of commerce.

Borrowers

Each Approval

E-Commerce Sites

Satisfied Customers

Turn your creative visions into reality with our No-Code App Builder. No complex coding is required - just your imagination taking centre stage as you craft apps that make a real impact. Readmore

Embark on your tech journey with a trusted companion – our Managed Development Services. From concept to execution, our experts are by your side, ensuring your digital solutions come to life smoothly and effectively. Readmore

Step confidently into the future of business with our Digital Transformation Services. We use cutting-edge technology to reshape your processes, boost efficiency, and create a flexible foundation for innovation to thrive. Readmore

Leave the complexities of risk and compliance to us. Our services provide the guidance and technology needed to keep your business in line with regulations, so you can focus on what matters most - growing your business. Readmore

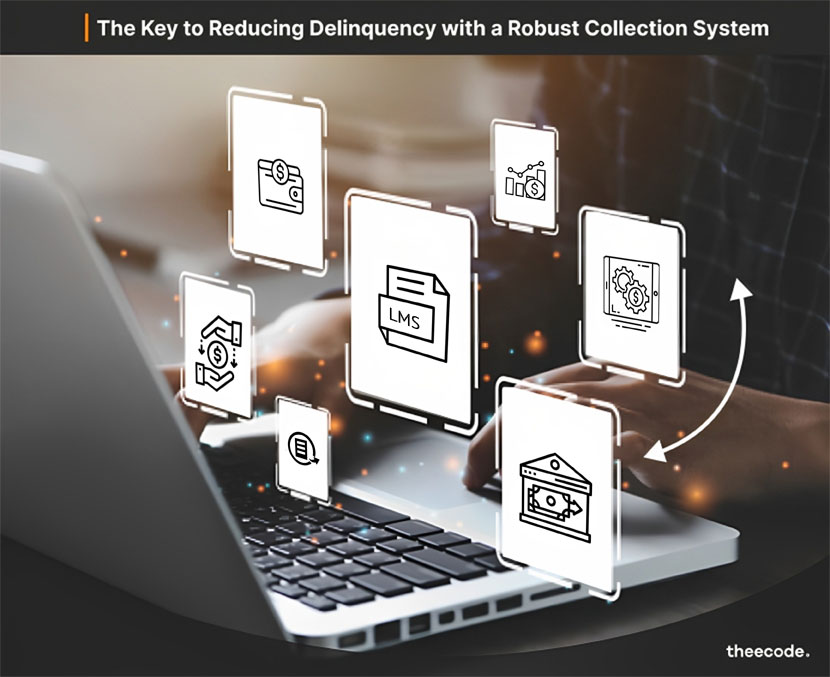

When extending credit, it is indeed crucial to ensure that loan repayments are collected promptly. However, imagine a scenario where a lending institution processes thousands of loans each month.

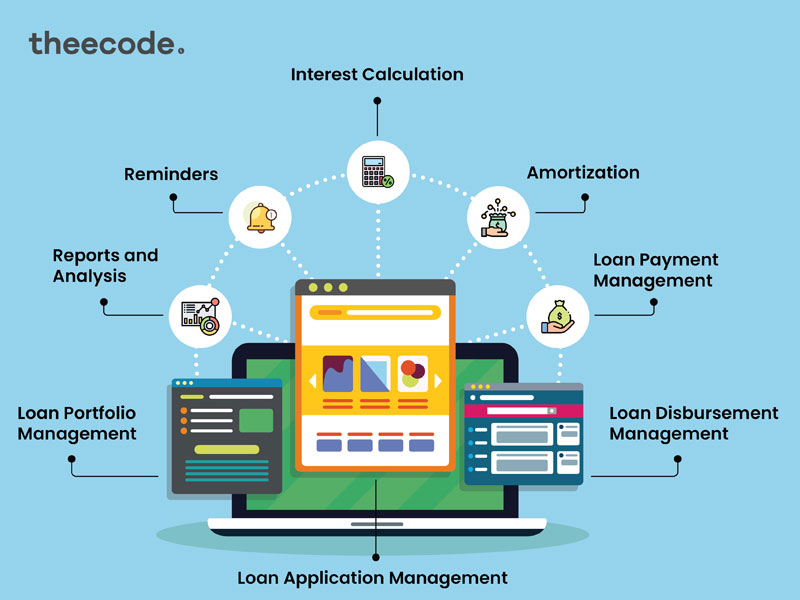

Running a successful business is no easy feat, and there are many factors that can hinder its success. In the lending industry, this is especially true, with a crowded market and ever-changing customer expectations.

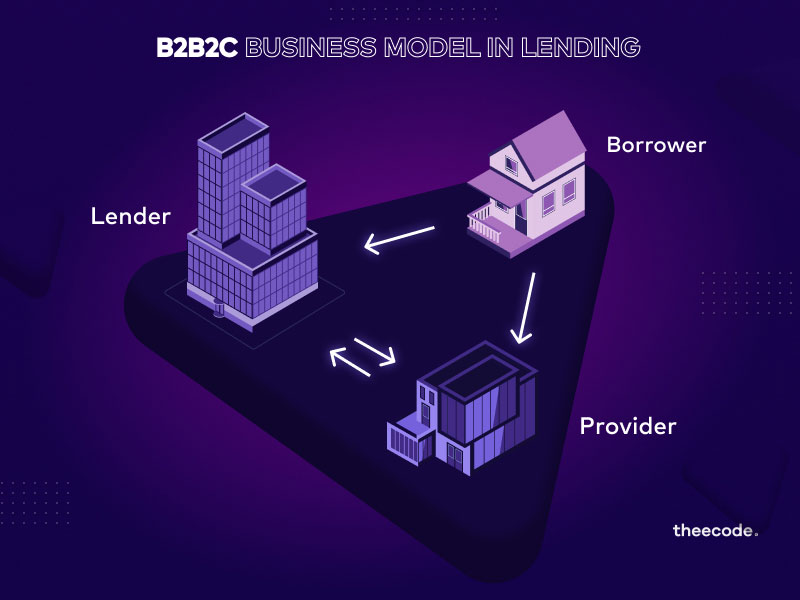

The lending process may seem simple on the surface - a borrower requests a loan, undergoes verification, receives approval from the lender and then repay the principal amount along with interest.

In the current decade, technology has become an integral part of most businesses and companies. This has led to the emergence of various forms of technology, with one of them being vertical SaaS.

In recent years, digital payment adoption has become a global phenomenon, prompting countries and states to strive for efficiency, speed, and security.

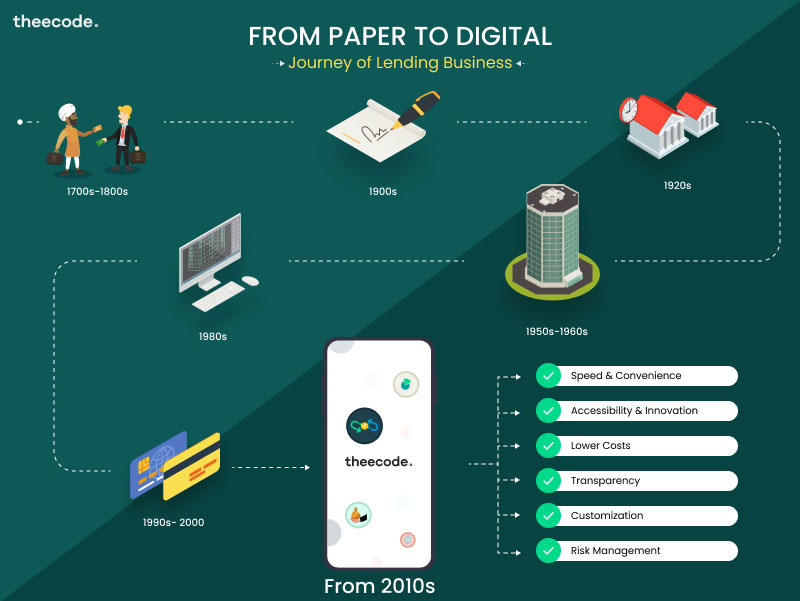

The lending business has come a long way from paper-based processes to digital lending platforms. In the past, getting a loan was a cumbersome and time-consuming process.

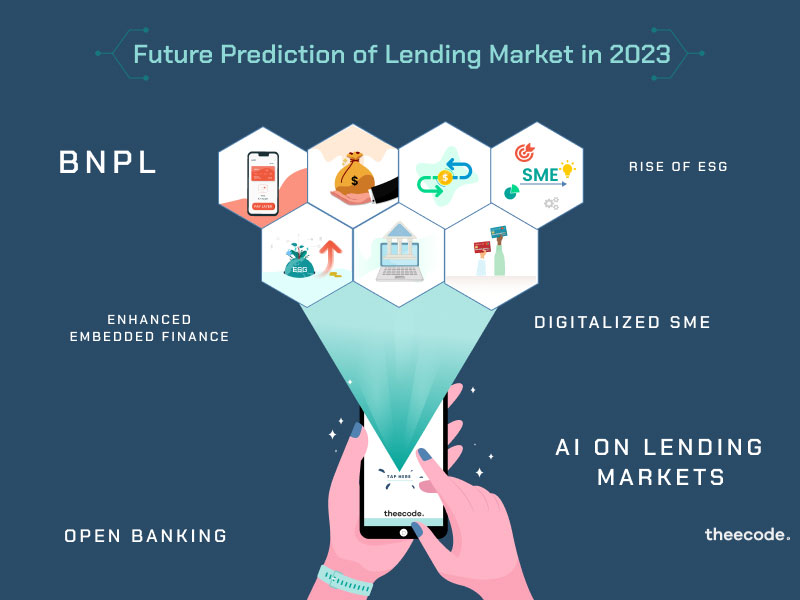

With the arrival of a new year, it's time to reflect on the past and anticipate the future of the lending market in the fintech industry.

The concept of finance and technology was introduced to the world years ago and it has been booming since then.

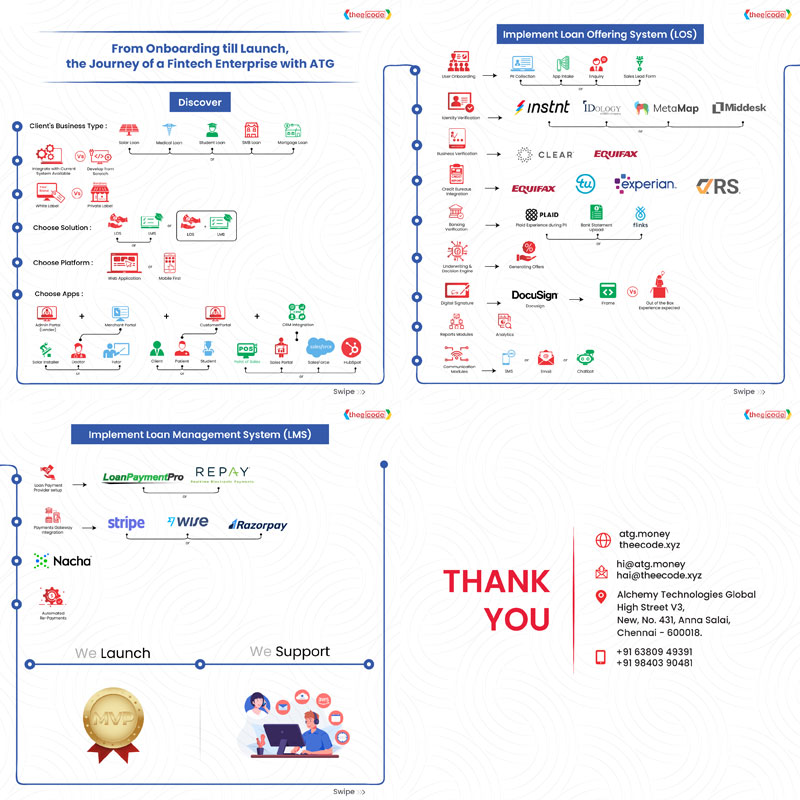

How at ATG (Alchemy Technologies Global) we enable our Clients from Initiation to Execution on their journey to become a Fintech Leader.

© Copyright 2024 Theecode Technologies Pvt Ltd. All Rights Reserved